| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| |

| Preliminary Proxy Statement | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) of the Securities

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| |

| Preliminary Proxy Statement | |

| |

| Confidential, for Use of the Commission Only (as permitted by Rule | |

| |

| Definitive Proxy Statement | |

| |

| Definitive Additional Materials | |

| |

| Soliciting Material | |

CARDINAL HEALTH, INC.

(Name of Registrant as Specified Inin Its Charter)

(NamesName of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table |

| LETTER TO CARDINAL HEALTH SHAREHOLDERS | 2 |

| 11 | ||

| Forward-Looking Statements | 12 | |

GREGORY B. KENNY Chairman of the Board | LETTER TO CARDINAL HEALTH SHAREHOLDERSSEPTEMBER 27, 2023 The past year brought about key changes at Cardinal Health and, with them, strong results. The Board and management remain committed to our refreshed strategic priorities, and we look forward to continuing this work in the year ahead. FISCAL 2023 PERFORMANCE We delivered strong financial performance in fiscal 2023, growing revenue and earnings at the enterprise level. We grew Pharmaceutical segment profit an impressive 13%, and, in the Medical segment, we drove significant sequential improvement in operating performance — from a segment loss in the first quarter to over $80 million of segment profit in the fourth quarter. We also generated $2.8 billion of operating cash flow and returned $2.5 billion to shareholders through share repurchases and dividends. TAKING ACTION TO MAXIMIZE AND SUSTAIN VALUE As a result of the Board’s succession planning process, in August 2022, we named Jason Hollar as the company’s new CEO. Under Jason’s leadership, we took decisive action this year to advance our three strategic priorities: building on the growth and resiliency of our Pharmaceutical segment; executing our Medical Improvement Plan initiatives; and relentlessly focusing on shareholder value creation. Consistent with what we shared at our Investor Day in June, our strong fiscal 2023 results were achieved through a commitment to prioritize the core of our business and to better serve our customers, so they, in turn, could focus on caring for their patients. We simplified our operations by streamlining our organizational structure, exiting non-core product lines, and rationalizing our geographic and manufacturing footprints to meet our current business needs. We made key leadership changes, adding talent in critical positions across the enterprise. We formed and recently extended the term of the Board’s Business Review Committee tasked with evaluating our strategy, portfolio, capital allocation framework, and operations. Key outputs of this review to date include the completion of a review of the Pharmaceutical segment and the launch of our new NavistaTMNetwork supporting community oncologists, our recent announcement of further investment in our Nuclear and Precision Health Solutions business, and the merger of the segment’s OutcomesTMbusiness into Transaction Data System. UPDATES TO THE COMPOSITION OF OUR BOARD The cooperation agreement we entered into with Elliott Management last September included the addition of four new independent directors, each of whom bring a depth of experience and skills, including healthcare and technology, which are core to our strategic direction. These new directors were welcomed by our existing directors, and they contributed to the Board’s dialogue over the past year. |

CARDINALHEALTH 2023 Proxy Statement |2

As noted in the proxy statement, Carrie Cox and Bruce Downey will be departing the Board when their terms expire this year. Both Carrie and Bruce have provided indispensable guidance over the past 14 years, helping to position Cardinal Health well for the future. On behalf of the Board, I would like to thank Carrie and Bruce for their many years of service and valuable contributions.

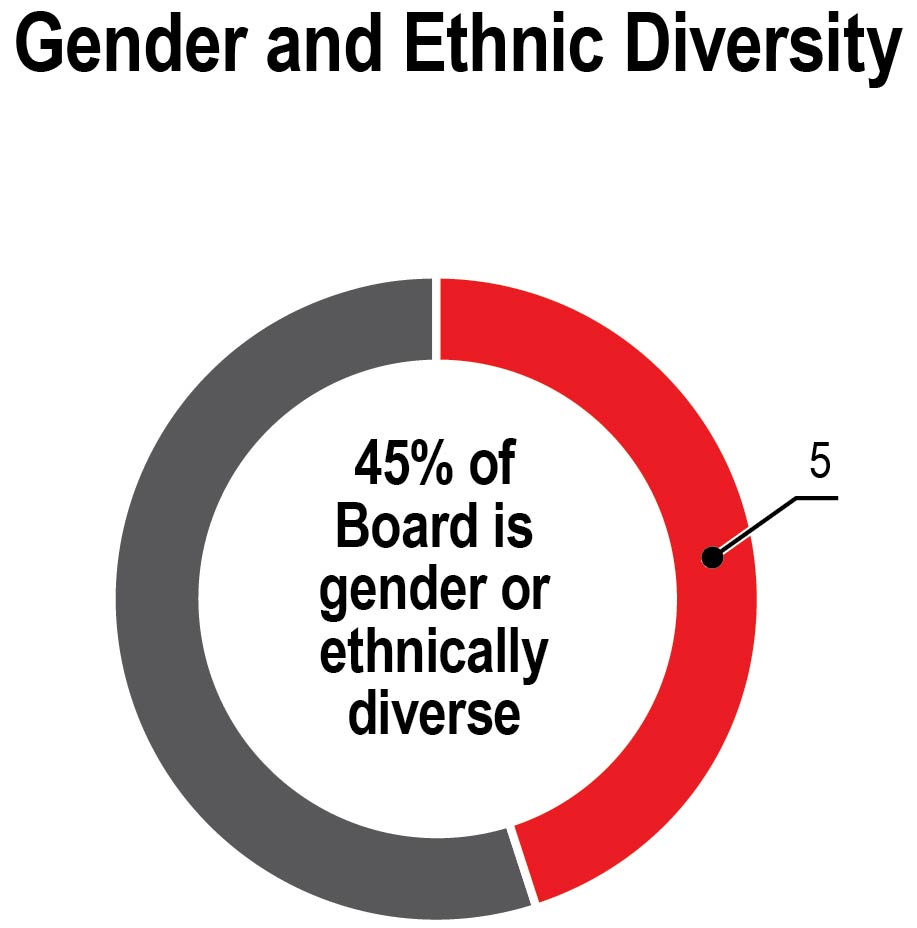

Following Carrie’s and Bruce’s departures, the total number of directors will be reduced to eleven, ten of whom are independent and seven of whom are gender or racially or ethnically diverse.

OPERATING SUSTAINABLY

The Board is highly engaged on our environmental, social, and governance, or ESG, priorities and provides oversight of the company’s overall efforts through our Governance and Sustainability Committee. As detailed in our robust ESG report released this past January, we remain steadfast in our strategic approach to deliver a sustainable future. We believe that our existing ESG initiatives align well with, and can help drive, our existing business strategies. Our ESG priorities are organized into four broad categories focused on empowering our people, creating value for our customers and communities, operating sustainably and responsibly, and having strong governance, ethics, and compliance. These priorities inform our ESG strategies, goals, and disclosure. Details on progress against key goals are available in our ESG reports and on our website.

SHAREHOLDER ENGAGEMENT

This past summer, the company contacted shareholders representing 52% of our outstanding shares and met with shareholders representing 37% of our outstanding shares. Another independent director and I participated in select meetings with shareholders. In these discussions, we provided updates on our strategy and ongoing business review process, Board composition and refreshment, senior leadership transitions, executive compensation, and sustainability topics. These are important conversations, and we greatly value the insights that our shareholders provide.

LOOKING FORWARD

Our success would not be possible without the commitment of our employees, who remain focused on our mission to improve the lives of people every day. They continue to deliver for our customers and are foundational to our success.

On behalf of our Board, I thank you for your share ownership and continued support of Cardinal Health. Following a strong first year under Jason Hollar’s leadership, the Board is excited to oversee execution of the company’s strategic priorities designed to achieve our targeted growth for fiscal 2024 and beyond. We look forward to working with you and all our partners to ensure that Cardinal Health continues its essential role in healthcare.

Sincerely,

Gregory B. Kenny

Chairman of the Board

CARDINALHEALTH 2023 Proxy Statement |3

September 27, 2023

The 2023 annual meeting of shareholders (the “Annual Meeting”) will be conducted virtually. You will be able to participate in the virtual meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CAH2023.

VIRTUAL MEETING

The Annual Meeting is a virtual shareholder meeting at www.virtualshareholdermeeting.com/CAH2023.

RECORD DATE

Shareholders of record as of September 18, 2023 are entitled to vote at the Annual Meeting.

PROXY VOTING

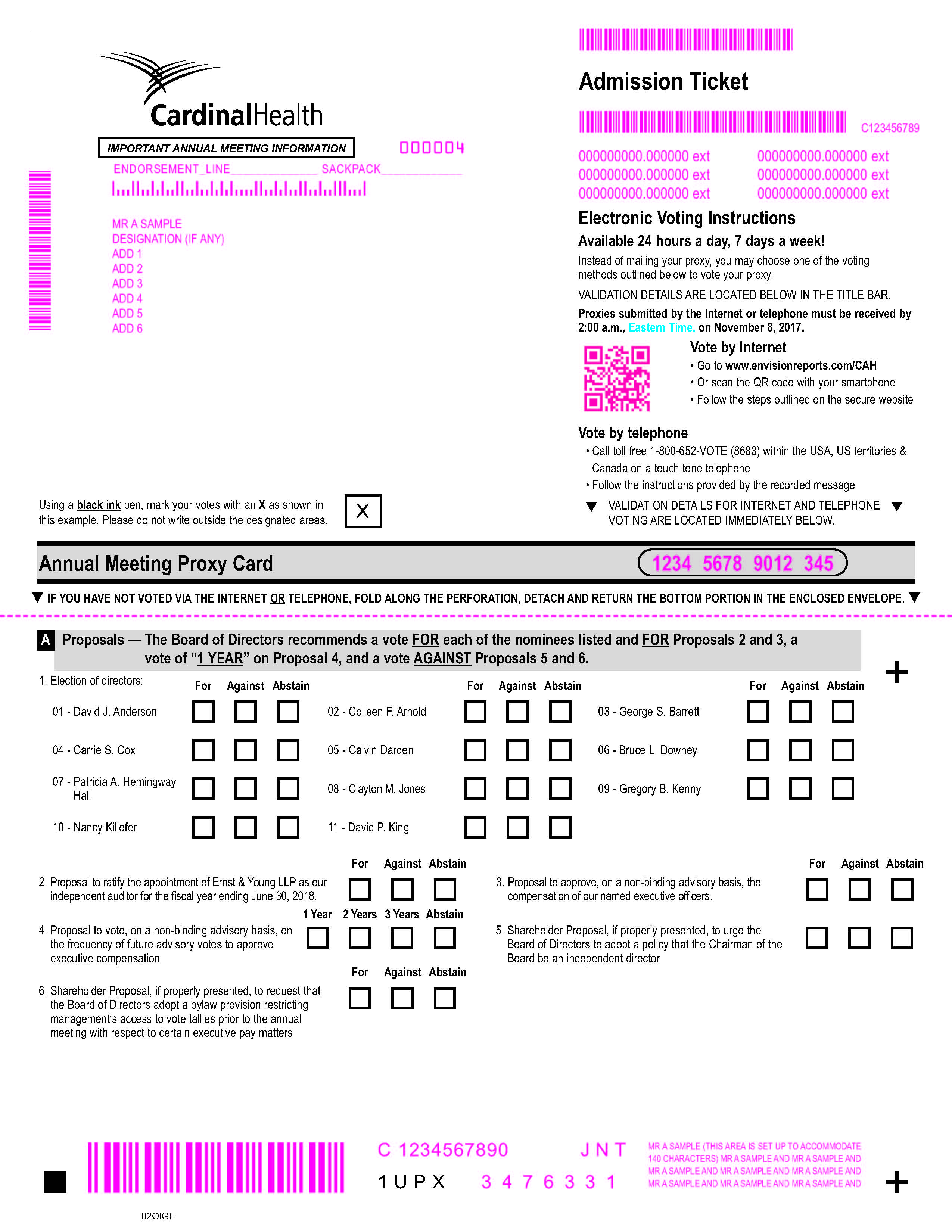

Please vote your shares promptly to ensure the presence of a quorum during the Annual Meeting. Voting your shares now via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form will save the expense of additional solicitation. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting, as your proxy is revocable at your option.

WEDNESDAY, NOVEMBER 15, 2023

8:00 a.m. Eastern Time

Virtual Meeting

www.virtualshareholdermeeting.com/CAH2023

| VOTE IN ADVANCE OF THE MEETINGIN ONE OF FOUR WAYS: | |||

| INTERNET Visit 24/7 www.proxyvote.com | ||

| BY TELEPHONE Call the toll-free number 1-800-690-6903 within the United States, U.S. territories, or Canada | ||

| BY MAIL Mark, sign, and date proxy card and return by mail in enclosed postage-paid envelope | ||

| See page 78 for instructions on how to attend and vote your shares | ||

| Please refer to the enclosed proxy materials orthe information forwarded by your bank, broker,or other holder of record to see which votingmethods are available to you. | |||

We are requesting your vote to:

ITEMS OF BUSINESS

| Elect the 11 director nominees named in the proxy statement; |

| Ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, 2024; |

| Approve, on a non-binding advisory basis, the compensation of our named executive officers; |

| To vote, on a non-binding advisory basis, on the frequency of future advisory votes to approve the compensation of our named executive officers; |

| Vote on two shareholder proposals described in the proxy statement, if properly presented at the Annual Meeting; and |

| Transact such other business as may properly come before the meeting or any adjournment or postponement. |

MEETING DETAILS

See “Proxy Summary” and “Other Matters” for details.

By Order of the Board of Directors.

Patrick C. Pope

Executive Vice President, General Counsel, and Secretary

September 27, 2023

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on November 15, 2023: The notice of annual meeting of shareholders, the accompanying proxy statement, and our 2023 annual report to shareholders are available at www.proxyvote.com. These proxy materials are first being sent or made available to shareholders commencing on September 27, 2023.

CARDINALHEALTH 2023 Proxy Statement |4

This summary highlights certain information contained elsewhere in our proxy statement. This summary does not contain all the information that you should consider, and you should carefully read the entire proxy statement and our 2023 annual report to shareholders before voting. References to our fiscal years in the proxy statement mean the fiscal year ended or ending on June 30 of such year. For example, “fiscal 2023” refers to the fiscal year ended June 30, 2023.

Headquartered in Dublin, Ohio, Cardinal Health, Inc. is a global healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home. We distribute pharmaceuticals and medical products and provide cost-effective solutions that enhance supply chain efficiency. We connect patients, providers, payers, pharmacists, and manufacturers for integrated care coordination and better patient management. We manage our business and report our financial results in two segments: Pharmaceutical and Medical.

Fiscal 2023 was an inflection point for Cardinal Health, with improved performance, strong execution, and notable progress made against both short and long-term plans in new CEO Jason Hollar’s first year in the role. We finished the fiscal year well, with continued strong growth in the Pharmaceutical segment, robust cash flow generation, and improvement in the Medical segment, driven by execution of our Medical Improvement Plan.

| (1) | Total shareholder return (“TSR”) over the period from July 1, 2022 through June 30, 2023, expressed as a percentage, calculated based on changes in stock price assuming reinvestment of dividends. |

| • | Revenue was $205.0 billion, up 13% from the prior year. |

| • | GAAP operating earnings were $727 million, which included $1.2 billion in pre-tax goodwill impairment charges in the Medical segment. Non-GAAP operating earnings were $2.1 billion, a 3% increase over the prior year, reflecting Pharmaceutical segment profit growth, partially offset by a decrease in Medical segment profit. |

| • | GAAP diluted earnings per share (“EPS”) were $1.00, which included the pre-tax goodwill impairment charges ($1.1 billion after tax or $4.38 per share) in the Medical segment. Non-GAAP EPS was $5.79, a 14% increase over the prior year, reflecting the increase in non-GAAP operating earnings, lower interest and other expense, and a lower share count. |

| • | Pharmaceutical segment profit grew 13%, while Medical segment profit decreased 49%. |

| • | We generated $2.8 billion in operating cash flow and returned over $2.5 billion to shareholders in share repurchases ($2.0 billion) and dividends ($525 million), strengthened the balance sheet by repaying $550 million in long-term debt, and invested over $480 million back into our businesses to drive organic growth. |

| • | We continued to streamline our cost structure and surpassed our enterprise cost savings target for the fifth consecutive year. |

| • | The Board’s Business Review Committee and management made progress on the ongoing review of the company’s strategy, portfolio, capital allocation framework, and operations |

CARDINALHEALTH 2023 Proxy Statement |5

that began early in fiscal 2023. We announced at our Investor Day held on June 8, 2023, that we had completed the business and portfolio review of the Pharmaceutical segment, which included the launch of the new NavistaTMNetwork supporting community oncologists, the announcement that we would retain and invest in the segment’s Nuclear and Precision Health Solutions business, and the merger of the segment’s OutcomesTMbusiness into Transaction Data Systems. Prior to our Investor Day, we announced that the term of the Business Review Committee had been extended until July 15, 2024.

See Annex A for reconciliations to the comparable financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the reasons why we use non-GAAP financial measures.

CARDINALHEALTH 2023 Proxy Statement |6

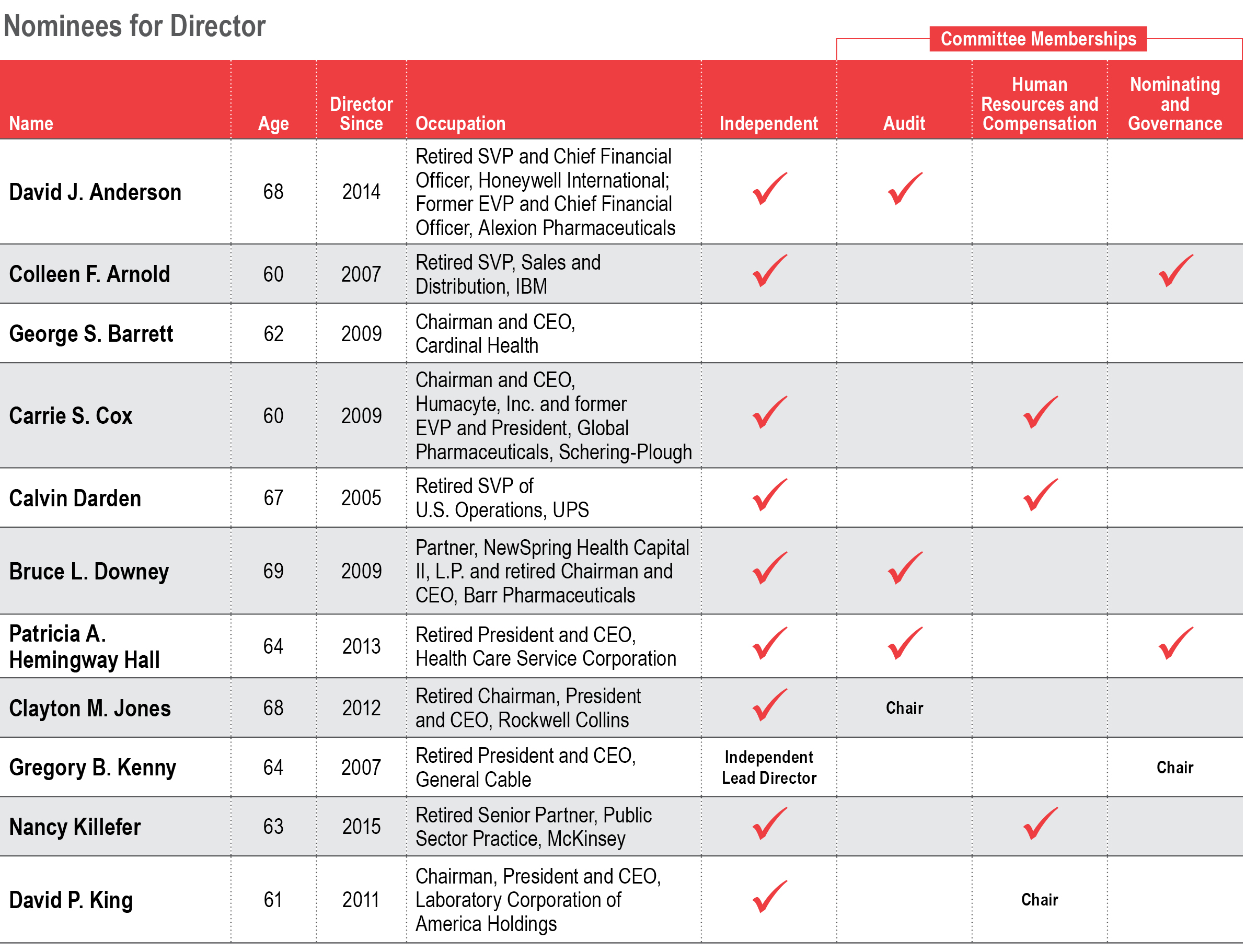

| Director | Committees | ||||||||||||||

| Nominee | Age | Occupation | Since | Independent | A | B(1) | G(2) | H(2) | R(2) | ||||||

| Steven K. Barg | 61 | Global Head of Engagement, Elliott Management Corporation | 2022 |  |  |  | ||||||||

| Michelle M. Brennan | 58 | Retired Value Creation Leader, Johnson & Johnson | 2022 |  |  |  | ||||||||

| Sujatha Chandrasekaran | 56 | Retired Senior EVP and Chief Digital and Information Officer, CommonSpirit Health | 2022 |  |  |  | ||||||||

| Sheri H. Edison | 66 | Retired EVP and General Counsel, Amcor plc | 2020 |  |  |  | ||||||||

| David C. Evans | 60 | Retired EVP and CFO, Scotts Miracle-Gro Company and Battelle Memorial Institute | 2020 |  |  |  | ||||||||

| Patricia A. Hemingway Hall | 70 | Retired President and CEO, Health Care Service Corporation | 2013 |  |  |  | ||||||||

| Jason M. Hollar | 50 | CEO, Cardinal Health, Inc. | 2022 |  | ||||||||||

| Akhil Johri | 62 | Operating Advisor to Clayton, Dubilier & Rice; Retired EVP and CFO, United Technologies Corporation | 2018 |  |  |  | ||||||||

| Gregory B. Kenny  | 70 | Retired President and CEO, General Cable Corporation | 2007 |  |  | |||||||||

| Nancy Killefer | 69 | Retired Senior Partner, Public Sector Practice, McKinsey & Company, Inc. | 2015 |  |  |  | ||||||||

| Christine A. Mundkur | 54 | Retired CEO, Impopharma Inc. | 2022 |  |  |  | ||||||||

| (1) | The Business Review Committee was formed on September 6, 2022 under the cooperation agreement that the company entered into with Elliott Associates, L.P. and Elliott International, L.P. On May 3, 2023, the term of the Business Review Committee was extended until July 15, 2024. |

| (2) | Current Human Resources and Compensation Committee Chair and Governance and Sustainability Committee member Carrie S. Cox has decided not to stand for re-election at the Annual Meeting. Ms. Cox will continue to serve as the Human Resources and Compensation Committee Chair through the November quarterly meeting, following which a new Committee Chair will be appointed. Current Governance and Sustainability Committee and Risk Oversight Committee member Bruce L. Downey was not nominated for re-election because he has reached the director retirement age of 75. |

| Key: |  | Chairman of the Board | ||||

| Chair | A: Audit | B: Business Review | H: Human Resources and Compensation | ||

| Member | G: Governance and Sustainability | R: Risk Oversight |

CARDINALHEALTH 2023 Proxy Statement |7

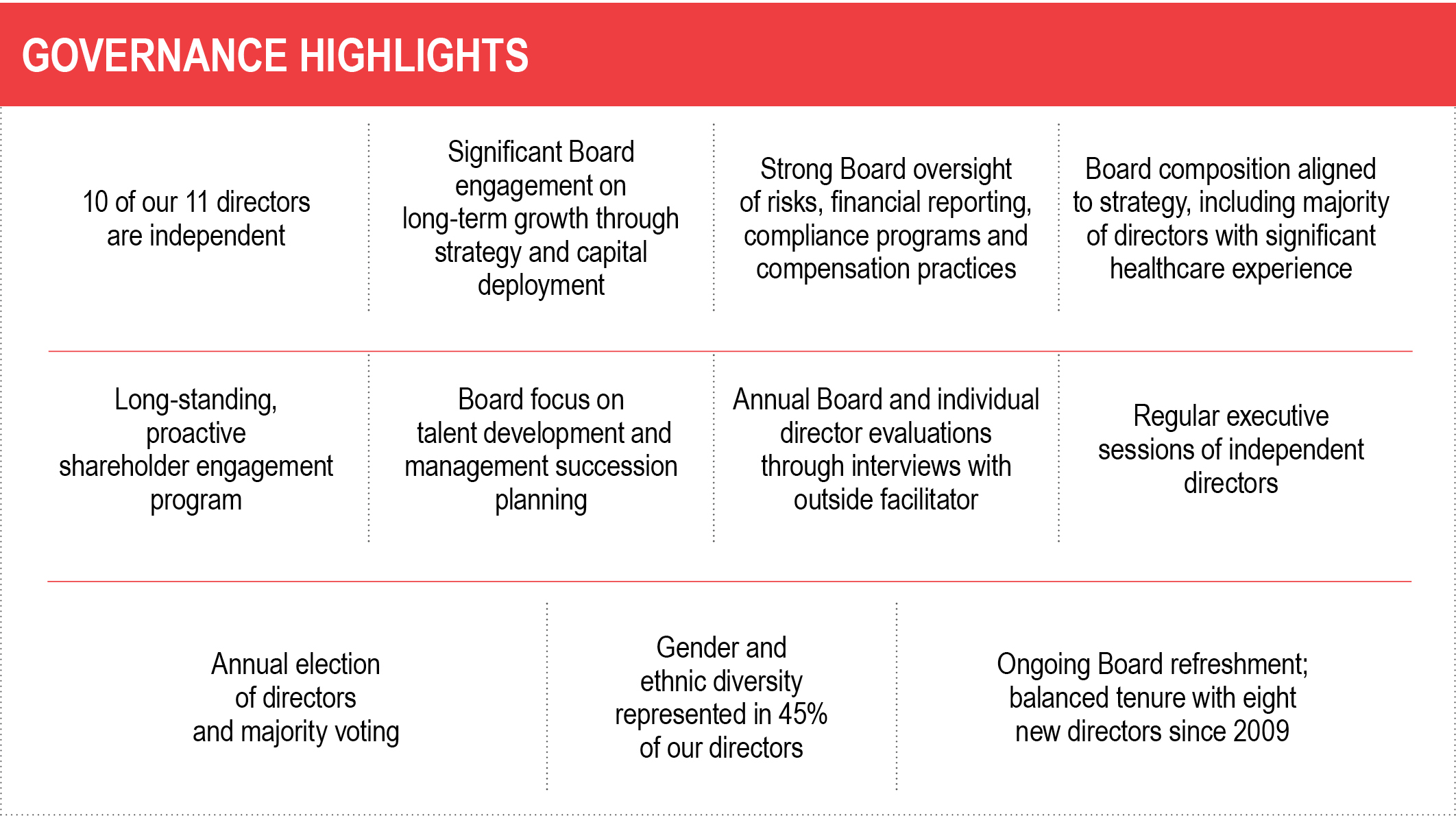

| 10 of our 11 director nominees are independent |  | Audit Committee assists the Board in monitoring financial and cybersecurity risks and enterprise risk management |  | Business Review Committee is conducting a review of the company’s strategy, portfolio, capital allocation framework, and operations |

| Independent, non-executive Chairman of the Board |  | Human Resources and Compensation Committee assists the Board in monitoring human capital and cultural health |  | Long-standing, proactive shareholder engagement program with director participation |

| 7 of our 11 director nominees are gender or racially/ethnically diverse |  | Governance and Sustainability Committee assists the Board in overseeing ESG matters |  | Robust Board evaluation process facilitated by an independent third party |

| Diverse candidates are included in new director searches |  | Risk Oversight Committee assists the Board in monitoring ethical, quality, and legal and regulatory compliance risks |  | Annual review of director commitments |

It has been our longstanding practice to meet with shareholders throughout the year so that management and the Board can better understand shareholder perspectives on governance, executive compensation, sustainability, and other topics.

Typically, our shareholder engagement process begins in the summer by soliciting feedback from institutional investors on governance practices and other topics, which feedback is shared with the Board. In the fall, we file our proxy statement and discuss proxy topics with institutional investors before the Annual Meeting. In the winter, we review voting results from the Annual Meeting.

Our independent Board Chairman, another independent director, and members of management engaged with shareholders during the summer of 2023 to provide updates on our strategy and ongoing business review process, Board composition and refreshment, senior leadership transitions, executive compensation, and ESG topics.

For more information on our approach to shareholder engagement and actions we have taken in response to shareholder feedback, see pages 32 and 33. For more information on our shareholder engagement efforts with respect to executive compensation and consideration of last year’s say-on-pay vote, see pages 41 and 42 of the Compensation Discussion and Analysis (“CD&A”).

On September 5, 2022, we entered into a cooperation agreement (the “Cooperation Agreement”) with Elliott Associates, L.P. and Elliott International, L.P. (together, “Elliott”). On May 3, 2023, we amended the Cooperation Agreement to extend its term until the later of (i) July 15, 2024 and (ii) five days following the date on which Mr. Barg, Elliott’s investor designee to the Board, or his successor ceases to serve on, or resigns from, the Board. Under the Cooperation Agreement, we agreed to appoint Mses. Brennan, Chandrasekaran, and Mundkur and Mr. Barg as new independent members of the Board effective September 6, 2022. Ms. Mundkur was initially identified by the Board’s Governance and Sustainability Committee.

CARDINALHEALTH 2023 Proxy Statement |8

We also agreed under the Cooperation Agreement to establish an advisory Business Review Committee to conduct a comprehensive review of the company’s strategy, portfolio, capital allocation framework, and operations. In connection with the extension of the Cooperation Agreement’s term, the Board extended the term of the Business Review Committee until July 15, 2024.

The amendment to the Cooperation Agreement extended Elliott’s agreement to abide by certain standstill restrictions and voting commitments.

Summaries of the Cooperation Agreement and the First Amendment to the Cooperation Agreement are included in Form 8-Ks filed with the U.S. Securities and Exchange Commission (“SEC”) on September 6, 2022 and May 4, 2023, respectively. The full Cooperation Agreement and First Amendment to the Cooperation Agreement are filed as exhibits to the Form 8-Ks.

CARDINALHEALTH 2023 Proxy Statement |9

Our ESG priorities below, which we had refreshed with the assistance of an ESG consultant in fiscal 2022 through a series of internal and external surveys and interviews, inform our ESG strategy, goals, and disclosures. We manage these issues through dedicated teams throughout the company with oversight from the Board’s Governance and Sustainability Committee and management’s ESG Governance Committee, who ensure that ESG matters are aligned with and support our business strategy.

We continue to advance ESG efforts across the company, working together with colleagues across the business on our priorities and transparently reporting on our progress. Here are a few of our fiscal 2023 ESG highlights:

We focused in fiscal 2023 on advancing a workplace culture where every employee is invited and encouraged to be their authentic selves, through our ongoing focus on diversity, equity, and inclusion (“DE&I”) initiatives and providing mental health resources for employees and their families. A variety of learning and development programs supported career advancement, and a robust employee assistance program helped promote employees’ well-being.

This past year, we baselined our Scope 3 greenhouse gas (“GHG”) emissions and submitted a near-term science-based target to the Science Based Targets initiative (SBTi) for validation that combines our existing public Scope 1 and Scope 2 emission reduction goal of 50% by fiscal 2030 with a new Scope 3 target. In fiscal 2023, we also signed on to the White House and Health and Human Services Health Sector Climate Pledge. We believe that these initiatives align well with, and can help drive, our existing business strategies. And while we continue to make progress on achieving our GHG reduction goals, we believe that collaborating with our customers and others across the healthcare industry will be essential to addressing the impacts of climate change.

In our fiscal 2022 ESG report issued in January 2023, we provided extensive information on different ESG matters and included appendices that organized and reported the information according to the most widely used reporting standards and frameworks, including those of the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD). We expect to issue our fiscal 2023 ESG report in January 2024.

In fiscal 2023, the Cardinal Health Foundation and the company donated $8.4 million to charitable causes. Cardinal Health employees donated an additional $1.0 million to charitable causes representing more than 1,300 organizations across the globe and gave more than 54,600 hours of volunteer service.

More information about our ESG efforts can be found in our ESG reports and on our website at www.cardinalhealth.com under “About Us — Environmental, Social and Governance (ESG).” The information in our ESG reports and on our website is not incorporated by reference into, and does not form any part of, this proxy statement. Any targets or goals discussed in this proxy statement and our ESG reports may be aspirational, and as such, no guarantees or promises are made that these goals will be met. Furthermore, statistics and metrics disclosed in this proxy statement and in our ESG reports are estimates and may be based on assumptions that turn out to be incorrect. We do not undertake or assume any obligation to update or revise any of this information.

CARDINALHEALTH 2023 Proxy Statement |10

|  |  |

| TIME AND DATE | PLACE | RECORD DATE |

| Wednesday, November 15, 2023 8:00 a.m. Eastern Time | Virtual Meeting www.virtualshareholdermeeting.com/CAH2023 | September 18, 2023 |

This year’s Annual Meeting will be conducted virtually. You will be able to participate in the virtual Annual Meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CAH2023 and entering the 16-digit control number included in the notice of internet availability of proxy materials, voting instruction form, or proxy card that was sent to you with this proxy statement.

If you do not have a 16-digit control number, you may still attend the meeting as a guest in listen-only mode. To attend as a guest, please visit www.virtualshareholdermeeting.com/CAH2023 and enter the information requested on the screen to register as a guest. Note that you will not have the ability to vote or ask questions during the meeting if you participate as a guest.

For further information on how to attend and participate in the virtual Annual Meeting, please see “Other Matters” beginning on page 78 in this proxy statement.

Shareholders will be asked to vote on the following proposals at the Annual Meeting:

| Proposal | Board Recommendation | Page Reference | ||

| PROPOSAL 1: to elect the 11 director nominees named in this proxy statement | FOR each director nominee | 13 | ||

| PROPOSAL 2: to ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, | FOR | 36 | ||

| FOR | 39 | |||

| FOR every ONE YEAR | 39 | |||

| Annual Meeting | ||||

You can return voting instructions in advance of Directors

|  |  |

| INTERNET | TELEPHONE | |

www.proxyvote.com |  | |

| Call the toll-free number 1-800-690-6903 within the United States, U.S. territories, or Canada and follow the instructions provided by the recorded message | ||

and return it by mail in the enclosed postage-paid envelope |

CARDINALHEALTH 2023 Proxy Summary

| Back to Contents | |

Certain statements in this proxy statement may be considered “forward-looking” statements within the meaning of the applicable securities laws. Forward-looking statements include those preceded by, followed by, or that include the generic pharmaceutical pricing environment, partially offsetwords “will,” “may,” “could,” “would,” “should,” “believes,” “expects,” “forecasts,” “anticipates,” “plans,” “estimates,” “targets,” “projects,” “intends,” or similar expressions. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from historical experience or from future results expressed or implied by such forward-looking statements. Potential risks and uncertainties include, but are not limited to, the benefits from Red Oak Sourcing.

CARDINALHEALTH 2023 Proxy Statement |12

Our Board currently has 13 members. Eleven of our directors are standing for election at the Annual Meeting to serve until the next annual meeting of shareholders and until their successor is elected and qualified or until their earlier resignation, removal from office, or death. Each of the nominees is a current director who was elected at last year’s annual meeting of shareholders.

Carrie S. Cox, a director since 2009, has decided not to stand for re-election at the Annual Meeting. Bruce L. Downey, a director since 2009, was not nominated for re-election because he has reached the director retirement age of 75 set forth in our Corporate Governance Guidelines. The size of the Board will be reduced to 11 at the time of the Annual Meeting.

Each director nominee agreed to be named in this proxy statement and to serve if elected. If, due to death or other unexpected occurrence, one or more of the director nominees is not available for election, proxies will be voted for the election of any substitute nominee the Board selects.

| THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE NOMINEES LISTED ON PAGES 14 THROUGH 19. |

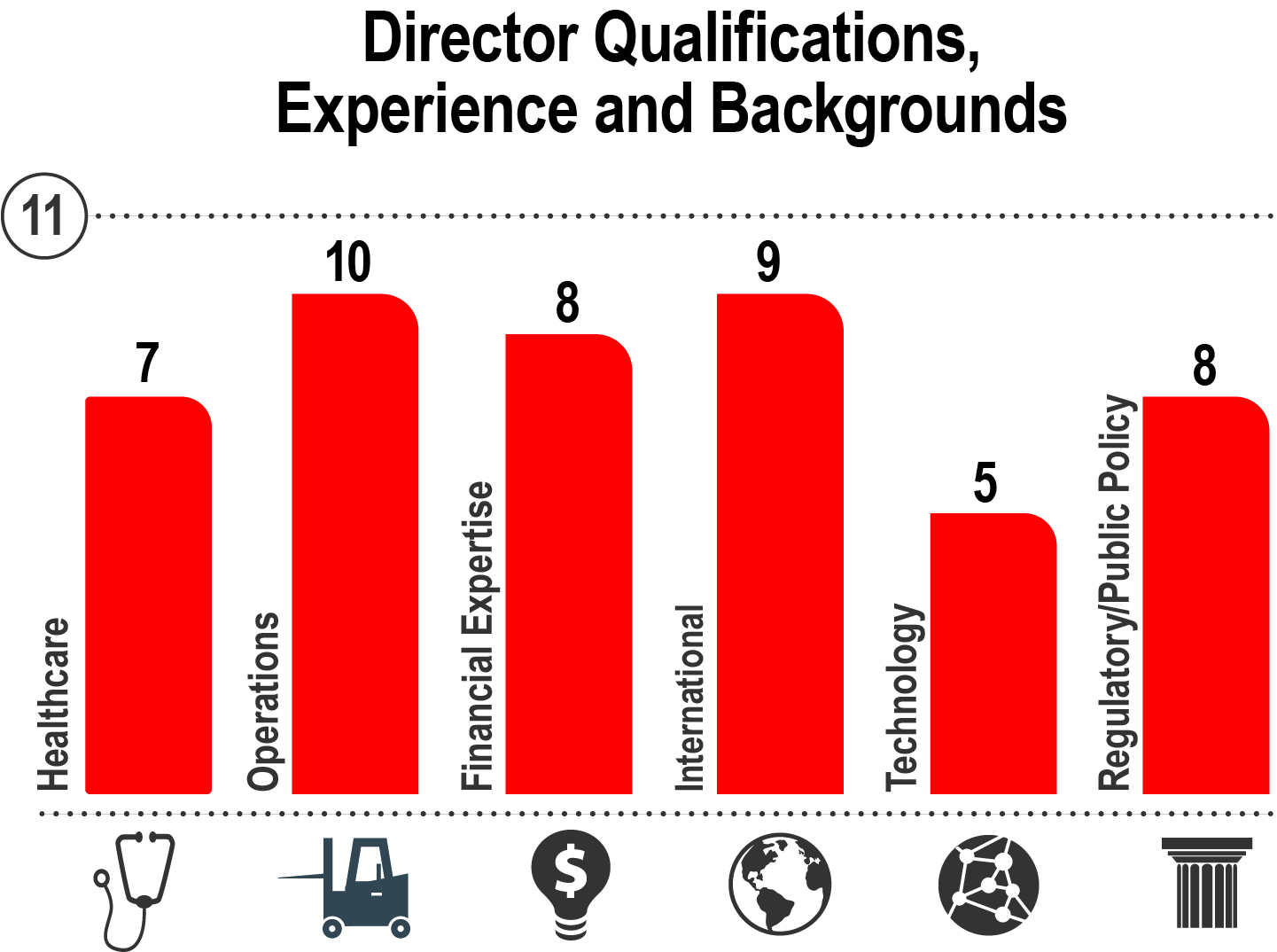

The Board’s Governance and Sustainability Committee considers and reviews with the Board the appropriate skills and characteristics for directors in the context of the Board’s current composition and objectives. Criteria for identifying and evaluating director candidates include, among other things:

| • | business experience, qualifications, attributes, and skills, such as relevant industry knowledge (including healthcare, supply chain, and logistics) and experience in operations, technology, accounting and finance, strategic planning, and international markets; |

| • | leadership experience as a CEO, CFO, or other senior executive, or leader of a significant business operation or function; |

| • | independence (including independence from the interests of any particular single group of shareholders); |

| • | judgment and integrity; |

| • | ability to commit sufficient time and attention to the activities of the Board; |

| • | diversity of occupational and personal backgrounds, including race and gender diversity; and |

| • | absence of conflicts with our interests. |

Our Corporate Governance Guidelines provide that, as part of the search process for each new director, the Governance and Sustainability Committee includes, and instructs any search firm to include, women and racially and ethnically diverse candidates in the pool from which candidates are selected.

CARDINALHEALTH 2023 Proxy Statement |13

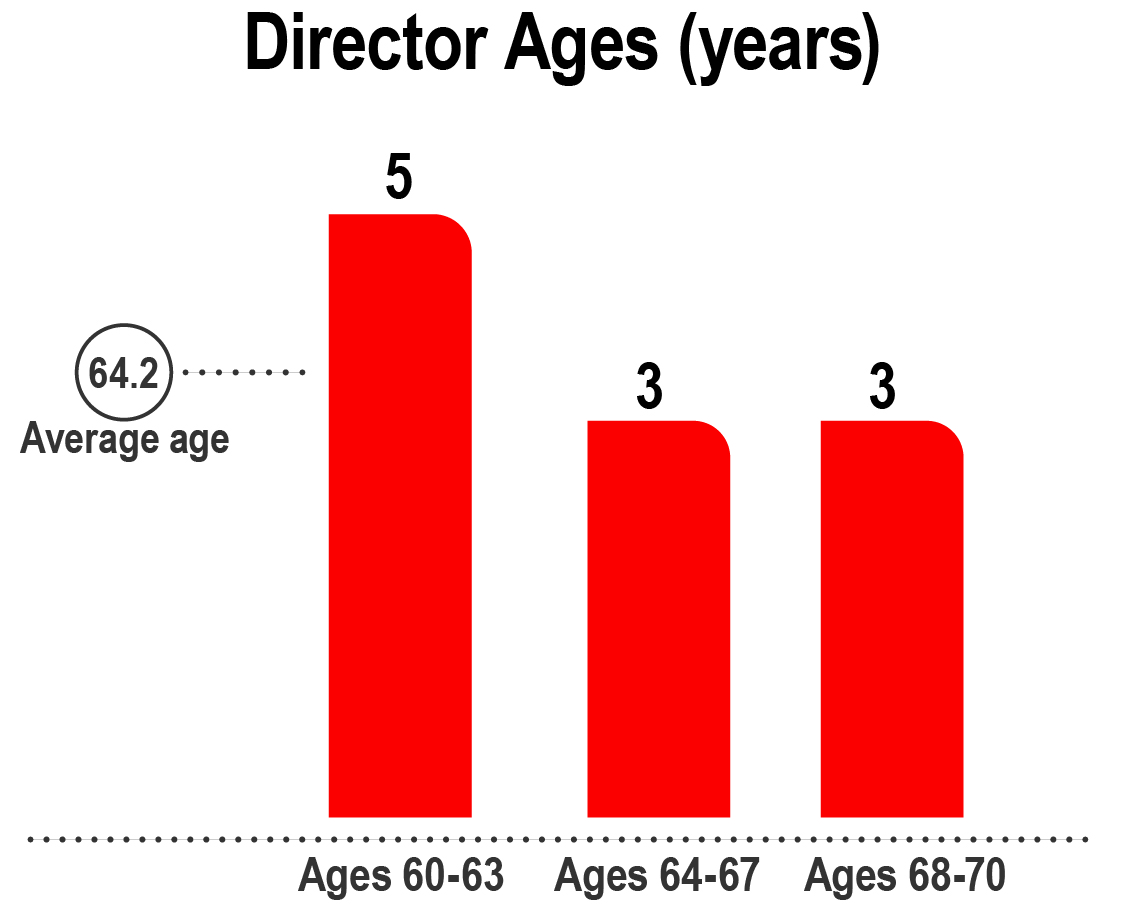

The Board seeks members that possess the experience, skills, and diverse backgrounds to perform effectively in overseeing our current and evolving business and strategic direction. All director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have business acumen, healthcare, global business, and technology experience, and operations and financial expertise. In addition, seven of the 11 director nominees are gender or racially or ethnically diverse.

Each director nominee has sound judgment and integrity and is able to commit sufficient time and attention to the activities of the Board. All director nominees other than our CEO are independent.

STEVEN K. BARG Age 61 Director since: 2022 Independent Director Board Committees: • Business Review • Governance and Sustainability | Global Head of Engagement at Elliott Management Corporation | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • Catalent, Inc. | • None | ||

Background Mr. Barg has served as Global Head of Engagement at Elliott Management Corporation (“EMC”), an investment management firm and affiliate of Elliott Investment Management L.P. (“EIM”), since February 2020. Mr. Barg served as CFO of Elliott Opportunity II Corp., a special purpose acquisition company sponsored by an affiliate of EIM, from February 2021 to July 2023. Prior to joining EMC, Mr. Barg was a Participating Managing Director at The Goldman Sachs Group, Inc., an investment bank and financial services company, from 2010 until November 2019. Earlier in his career, Mr. Barg ran the Asian equity and integrated capital markets businesses for UBS Group AG and served as a Managing Director in Equity Capital Markets at Credit Suisse Group AG. | |||

Qualifications: Mr. Barg brings to the Board financial expertise and extensive investment banking, capital markets, international markets, and corporate governance experience. Mr. Barg established and led what became Goldman Sachs’ Activism and Shareholder Advisory practice, founded and led Goldman Sachs’ M&A Capital Markets practice, and served as Co-head of Asian Equity Capital Markets in Hong Kong at Goldman Sachs. | |||

MICHELLE M. BRENNAN Age 58 Director since: 2022 Independent Director Board Committees: • Audit • Human Resources and Compensation | Value Creation Leader of Johnson & Johnson (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • Masimo Corporation | • Coupa Software Incorporated | ||

| Background Prior to her retirement in 2020, Ms. Brennan held various positions of increasing responsibility over 32 years at Johnson & Johnson, a researcher, developer, and manufacturer in the healthcare and consumer packaged goods fields, where she most recently served as Global Value Creation Leader from January 2019 to August 2020. She served as Company Group Chair of Medical Devices in Europe, the Middle East, and Africa (“EMEA”) from 2015 to December 2018, and from 2007 to 2014, she held various senior management positions including President of Enterprise Standards & Productivity, Worldwide President of Ethicon Energy, Regional President of Ethicon Endo Surgery for EMEA, the Mediterranean, and Iberia, and Worldwide Vice President of Business Development & Strategy for Ethicon Endo Surgery. | |||

| Qualifications: With an extensive career in senior management positions at Johnson & Johnson, Ms. Brennan brings to the Board substantial experience in the areas of healthcare, regulatory compliance, manufacturing operations, product quality, strategy, finance, and international markets. She also brings to the Board valuable perspectives and insights from her service on the Masimo board, including service on its Compensation Committee, and her prior service on the Coupa Software board, including service on its Audit Committee. | |||

CARDINALHEALTH 2023 Proxy Statement |14

SUJATHA CHANDRASEKARAN Age 56 Director since: 2022 Independent Director Board Committees: • Audit • Risk Oversight | Senior Executive Vice President and Chief Digital and Information Officer of CommonSpirit Health (retired) | ||

| Other public company boards: | |||

| Current | Within last five years | ||

| • American Eagle Outfitters, Inc. | • Barry Callebaut (SIX: BARN) | ||

| • Brenntag SE (FRA: BNR) | |||

| Background Ms. Chandrasekaran has been an advisor and independent consultant in the technology and consulting sectors since July 2022. Previously, she served as Senior Executive Vice President and Chief Digital and Information Officer for CommonSpirit Health, a non-profit health system, from 2019 to 2022. Prior to that, she was Global Chief Information Officer for Kimberly-Clark Corporation, a multinational personal care corporation focused on consumer products, from 2016 to 2019 and Senior Vice President, Global Chief Technology and Data Officer for Walmart Inc. from 2011 to 2016. Before joining Walmart, Ms. Chandrasekaran held senior technology, digital, and e-commerce roles at The Timberland Company and leadership roles at Nestlé S.A. | |||

| Qualifications Ms. Chandrasekaran brings to the Board substantial business operations, technology, artificial intelligence, and digital experience in a global context, spanning customer engagement, marketing, supply chain, healthcare operations, industrial manufacturing, and cybersecurity. Her deep technical and operational expertise contributes to the Board’s discussions regarding the technology, information security, and operational aspects of our business and strategy. She also brings to the Board valuable perspectives and insights from her service on the board of directors of American Eagle Outfitters (including service on its Audit, Compensation, and Nominating Committees) and on the supervisory board of Frankfurt Stock Exchange-listed Brenntag SE (including service on its Audit and Compliance Committee) and her prior service on the board of directors of Barry Callebaut AG, which is listed on the SIX Swiss Exchange. | |||

SHERI H. EDISON Age 66 Director since: 2020 Independent Director Board Committees: • Audit • Risk Oversight (Chair) | Executive Vice President and General Counsel of Amcor plc (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • Union Pacific Corporation | • AK Steel Holding Corporation | ||

Background Ms. Edison served as Executive Vice President and General Counsel of Amcor plc, a global packaging company, from 2019 through June 2021. Prior to that, she served as Senior Vice President, Chief Legal Officer, and Secretary of Bemis Company, Inc., also a global packaging company, from 2017 until Bemis was acquired by Amcor in 2019. Ms. Edison also served as Vice President, General Counsel, and Secretary of Bemis from 2010 to 2016. She came to Bemis from Hill-Rom Holdings Inc., a global medical device company, where she had served as Senior Vice President and Chief Administrative Officer from 2007 to 2010 and Vice President, General Counsel, and Secretary from 2004 to 2007. Ms. Edison began her career in private legal practice. | |||

| Qualifications: Having served in general counsel and other functional leadership roles at publicly traded manufacturing companies in industries such as medical devices and packaging, Ms. Edison brings to the Board substantial experience in the areas of healthcare, legal, regulatory compliance, corporate governance, strategy, and international markets. She also brings prior private legal practice experience as well as broad business experience, which further bolsters her understanding of a dynamic commercial, legal, compliance, and regulatory environment. Ms. Edison draws on her extensive legal, regulatory, and leadership experience in chairing the Risk Oversight Committee. She also brings to the Board valuable perspectives and insights from her service on the board of directors of Union Pacific (where she chairs the Corporate Governance, Nominating, and Sustainability Committee and serves on the Compensation and Benefits Committee) and from her prior service on the board of directors of AK Steel. | |||

CARDINALHEALTH 2023 Proxy Statement |15

DAVID C. EVANS Age 60 Director since: 2020 Independent Director Board Committees: • Audit • Risk Oversight | Executive Vice President and CFO of The Scotts Miracle-Gro Company and Battelle Memorial Institute (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • The Scotts Miracle-Gro Company | • None | ||

Background Most recently, Mr. Evans served as interim CFO of Scotts Miracle-Gro Company, a consumer lawn and garden products company, from August 2022 until December 2022, and he also served as Cardinal Health’s interim CFO from September 2019 through May 2020. Mr. Evans was Executive Vice President and CFO of Battelle Memorial Institute, a private research and development organization, from 2013 to 2018. Prior to that, he was CFO of The Scotts Miracle-Gro from 2006 until 2013 and Executive Vice President, Strategy and Business Development of Scotts from 2011 until 2013. In all, he spent 20 years in managerial roles at Scotts Miracle-Gro. | |||

Qualifications: Mr. Evans has a deep financial background as the former CFO at Scotts Miracle-Gro and Battelle. Having spent 25 years in financial leadership positions with these organizations, Mr. Evans brings to the Board substantial experience in the areas of finance and accounting, investor relations, capital markets, strategy, tax, and information technology. He also provides valuable insights in the areas of financial reporting and internal controls. Through his experience with Scotts Miracle-Gro, he provides a deep understanding of the financial aspects of, and capital deployment for, a publicly traded company. His service in an interim executive role at Cardinal Health brings company and industry knowledge to the Board. Mr. Evans also brings valuable perspectives and insights from his service on the board of directors of Scotts Miracle-Gro, where he chairs the Audit Committee. | |||

PATRICIA A. HEMINGWAY HALL Age 70 Director since: 2013 Independent Director Board Committees: • Governance and Sustainability (Chair) • Human Resources and Compensation | President and CEO of Health Care Service Corporation (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • ManpowerGroup Inc. | • Celgene Corporation | ||

| • Halliburton Company | |||

| Background Ms. Hemingway Hall served as President and CEO of Health Care Service Corporation, a mutual health insurer (“HCSC”), from 2008 until 2016. Previously, she held several executive leadership positions at HCSC, including President and Chief Operating Officer from 2007 to 2008 and Executive Vice President of Internal Operations from 2006 to 2007. | |||

| Qualifications: As retired President and CEO of HCSC, the largest mutual health insurer in the United States operating Blue Cross and Blue Shield Plans, Ms. Hemingway Hall brings to the Board valuable experience regarding evolving healthcare payment models and the industry’s regulatory environment. Beginning her career as a registered nurse, she later became a leader within the health insurance industry, gaining relevant experience in the areas of healthcare reform, regulatory compliance, government relations, finance, information technology, and human resources. Ms. Hemingway Hall chairs the Board’s Governance and Sustainability Committee and is a member of its Human Resources and Compensation Committee. She also brings valuable perspectives and insights from her service on the board of directors of ManpowerGroup and her former service on the boards of Celgene and Halliburton. She currently chairs ManpowerGroup’s Governance and Sustainability Committee and is a member of its Audit Committee. | |||

CARDINALHEALTH 2023 Proxy Statement |16

JASON M. HOLLAR Age 50 Director since: 2022 Board Committees: • Business Review (Chair) | CEO of Cardinal Health, Inc. | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • DaVita Inc. | • None | ||

Background Mr. Hollar was elected CEO of Cardinal Health effective September 1, 2022. From May 2020 to August 2022, he served as our CFO. Prior to that, he served as Executive Vice President and CFO of Tenneco Inc., a global automotive products and services company, from July 2018 to April 2020. He was Senior Vice President Finance at Tenneco Inc. from June 2017 to June 2018 and CFO of Sears Holding Corporation, a holding company for large consumer retailers across the United States, from October 2016 to April 2017. Sears filed for Chapter 11 bankruptcy in October 2018. Prior to Sears, Mr. Hollar worked with both Delphi Automotive and Navistar International in a number of senior finance roles. He served as Delphi’s Corporate Controller and as Vice President of Finance for the company’s powertrain systems division, which also included oversight of the Europe, Middle East, and Africa regions. At Navistar, he held finance positions of increasing responsibility in the company’s engine group, South American operations, and corporate financial planning and analysis. | |||

Qualifications: Having served as CEO of Cardinal Health since September 2022 and as its CFO from May 2020 to August 2022, Mr. Hollar draws on his knowledge of our daily operations and strategy and of our industry, customers, suppliers, employees, and shareholders to provide the Board with a unique and important perspective on our business. He brings to the Board extensive management, operational, and financial expertise, having led financial activities at Cardinal Health and other large public companies spanning financial strategy, capital deployment, treasury, tax, investor relations, risk management, accounting, and financial reporting. Mr. Hollar also brings to the Board substantial experience in capital markets, mergers and acquisitions, information technology, and international markets as well as experience working in manufacturing sites and leading lean, procurement, and inventory management teams. During his tenure at Cardinal Health, he has helped prioritize investments in growth businesses, strengthen our balance sheet, and efficiently return capital to shareholders. Mr. Hollar also brings relevant experience and perspectives to the Board from his service on the board of directors of DaVita Inc., where he chairs the Audit Committee. | |||

AKHIL JOHRI Age 62 Director since: 2018 Independent Director Board Committees: • Audit (Chair) • Business Review | Operating Advisor to Clayton, Dubilier & Rice; Executive Vice President and CFO of United Technologies Corporation (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • The Boeing Company | • None | ||

Background Mr. Johri has served as an Operating Advisor to Clayton, Dubilier & Rice, a global private equity manager, since 2021. Mr. Johri served as Executive Vice President and CFO of United Technologies Corporation (“UTC”), a provider of high technology products and services to the building systems and aerospace industries, from 2015 to November 2019 and retired from UTC in April 2020. From 2013 to 2014, he served as CFO and Chief Accounting Officer of Pall Corporation, a global supplier of filtration, separations, and purifications products, and from 2011 to 2013, he was Vice President of Finance and CFO of UTC Propulsion & Aerospace Systems, which included Pratt & Whitney and UTC Aerospace Systems. Mr. Johri’s prior roles with UTC include leading investor relations as well as holding senior financial roles with global business units, including 12 years in the Asia Pacific Region. | |||

Qualifications: Having spent more than 25 years in financial leadership positions with UTC and Pall Corporation, Mr. Johri brings to the Board substantial experience in the areas of global finance and accounting, investor relations, capital markets, mergers and acquisitions, tax, information technology, and international markets. He also provides valuable insights in the areas of financial reporting and internal controls. Through his experience in senior leadership roles with UTC’s businesses, he provides a deep understanding of the financial aspects of, and capital deployment for, a publicly traded multinational company. Mr. Johri also brings to the Board valuable perspectives and insights from his service on Boeing’s board of directors, including chairing its Audit Committee. | |||

CARDINALHEALTH 2023 Proxy Statement |17

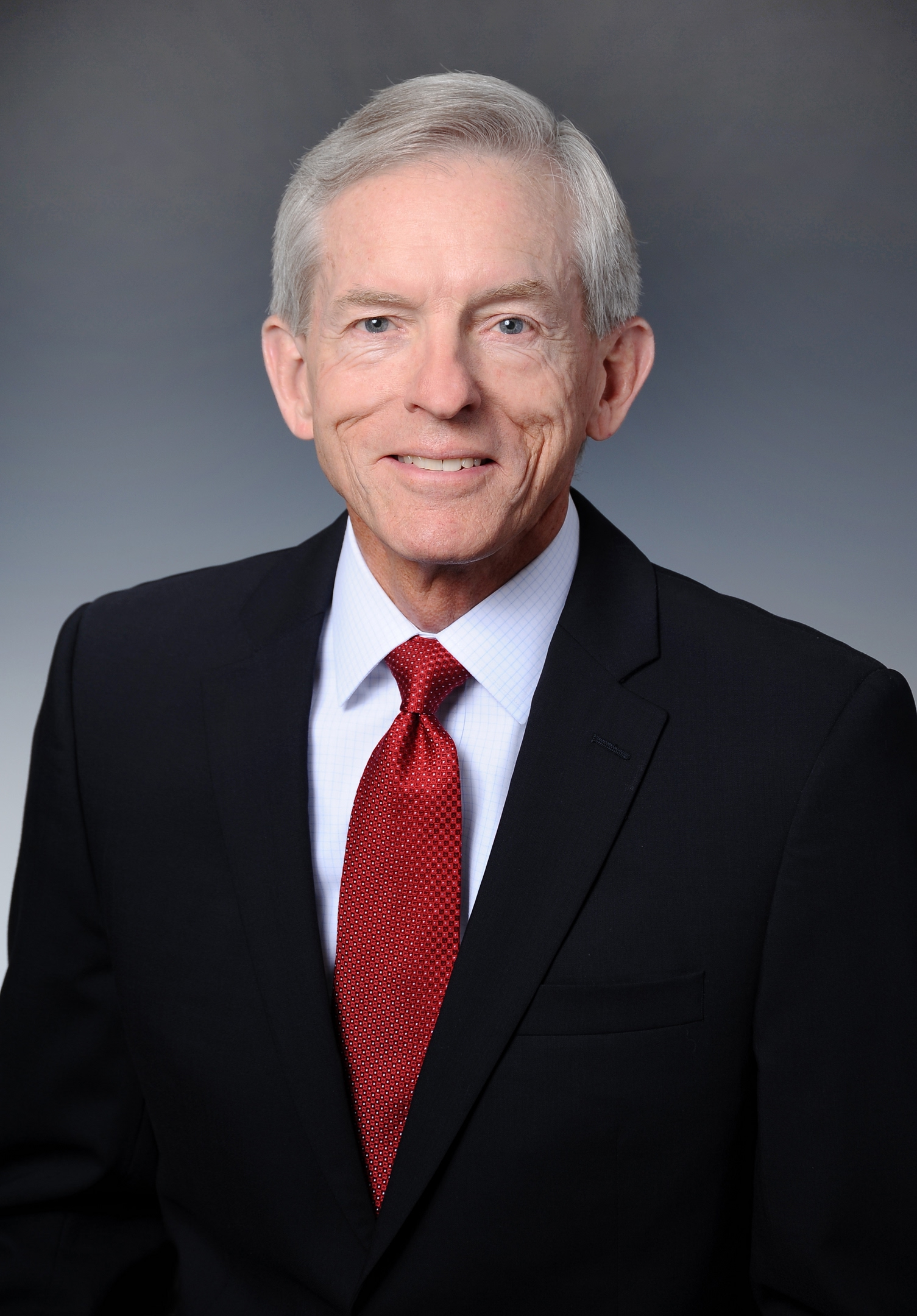

GREGORY B. KENNY Age 70 Director since: 2007 Independent Board Committees: • Governance and Sustainability | President and CEO of General Cable Corporation (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • Ingredion Incorporated | • AK Steel Holding Corporation | ||

| Background Mr. Kenny served as President and CEO of General Cable Corporation, a global manufacturer of aluminum, copper, and fiber-optic wire and cable products, from 2001 until 2015. Prior to that, he was President and Chief Operating Officer of General Cable from 1999 to 2001 and Executive Vice President and Chief Operating Officer from 1997 to 1999. Mr. Kenny previously served in executive level positions at Penn Central Corporation, where he was responsible for corporate business strategy, and in diplomatic service as a Foreign Service Officer with the U.S. Department of State. | |||

| Qualifications: Mr. Kenny has been our Chairman of the Board since November 2018 and was independent Lead Director from 2014 to 2018. Having spent 14 years as President and CEO of General Cable, he brings to the Board significant experience in the areas of corporate governance, manufacturing operations, international markets, finance, and human resources. He also draws upon his board governance and leadership experience previously chairing our Governance and Sustainability and Compensation Committees and chairing Ingredion’s board of directors and its Corporate Governance and Nominating Committee. Both in his current role as Chairman of the Board and his prior role as independent Lead Director, Mr. Kenny has promoted strong independent Board leadership and a robust, deliberative decision-making process among independent directors. Mr. Kenny also brings to the Board valuable perspectives and insights from his former service on the boards of directors of AK Steel and IDEX Corporation. | |||

NANCY KILLEFER Age 69 Director since: 2015 Independent Director Board Committees: • Governance and Sustainability • Human Resources and Compensation | Senior Partner, Public Sector Practice of McKinsey & Company, Inc. (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • Certara, Inc. | • Avon Products, Inc. | ||

| • Meta Platforms, Inc. | • Natura & Co Holding S.A. | ||

| • Taubman Centers, Inc. | |||

| Background Ms. Killefer served as Senior Partner of McKinsey & Company, Inc., a global management consulting firm, from 1992 until 2013. She joined McKinsey in 1979 and held a number of key leadership roles, including serving as a member of the firm’s governing board. Ms. Killefer founded McKinsey’s Public Sector Practice in 2007 and served as its managing partner until her retirement. She also served as Assistant Secretary for Management, CFO, and Chief Operating Officer for the U.S. Department of Treasury from 1997 to 2000. | |||

| Qualifications: Having served in key leadership positions in both the public and private sectors and provided strategic counsel to healthcare and consumer-based companies during her 30 years with McKinsey, Ms. Killefer brings to the Board substantial experience in the areas of strategic planning, including healthcare strategy, and marketing and brand-building. Her extensive experience as managing partner of McKinsey’s Public Sector Practice and as a chief financial officer of a government agency provides valuable insights in the areas of government relations, public policy, and finance. Ms. Killefer also brings to the Board valuable perspectives and insights from her service on the boards of directors of Certara (including chairing its Compensation Committee), and Meta Platforms (including chairing its Privacy Committee and serving on its Audit and Risk Oversight Committee), and her prior service on the boards of directors of Avon Products, Natura, and Taubman Centers. | |||

CARDINALHEALTH 2023 Proxy Statement |18

CHRISTINE A. MUNDKUR Age 54 Director since: 2022 Independent Director Board Committees: • Human Resources and Compensation • Risk Oversight | CEO of Impopharma Inc. (retired) | ||

| Other Public Company Boards: | |||

| Current | Within Last Five Years | ||

| • MannKind Corporation | • Lupin Limited (NSE: LUPIN) | ||

| Background Ms. Mundkur most recently served as CEO and non-voting Chair of the Board of Directors at Impopharma Inc., a generic pharmaceutical inhalation development company, from 2013 to 2017. Prior to that, she was President of CM Strategic Advisors, consulting on global pharmaceutical business strategies from 2011 to 2013. Ms. Mundkur also previously served as President and CEO of the U.S. Division and Head of Commercial Operations for North America for Sandoz, Inc., a division of the Novartis Group and a global generic and biosimilar pharmaceutical business, from 2009 to 2010. Prior to that, she served in 2008 as CEO of Barr Laboratories, Inc., a subsidiary of Barr Pharmaceuticals, Inc., until Barr Pharmaceuticals was acquired by Teva Pharmaceutical Industries Ltd. Ms. Mundkur started her career at Barr Pharmaceuticals as associate counsel in 1993 and held several positions of increasing responsibility in the company’s quality and regulatory departments. | |||

| Qualifications: Having served in a variety of executive, legal, quality and regulatory compliance, and consulting roles over more than 20 years in the pharmaceutical industry, Ms. Mundkur brings to the Board substantial experience in the areas of healthcare, legal, quality and regulatory compliance, manufacturing operations, strategy, finance, and international markets. She also brings to the Board valuable perspectives and insights from her service on the board of directors of MannKind Corporation, a global biopharmaceutical company focused on treatments for diabetes, and prior service on the board of directors of Lupin Limited, a global biopharmaceutical company listed on the National Stock Exchange of India Ltd. | |||

CARDINALHEALTH 2023 Proxy Statement |19

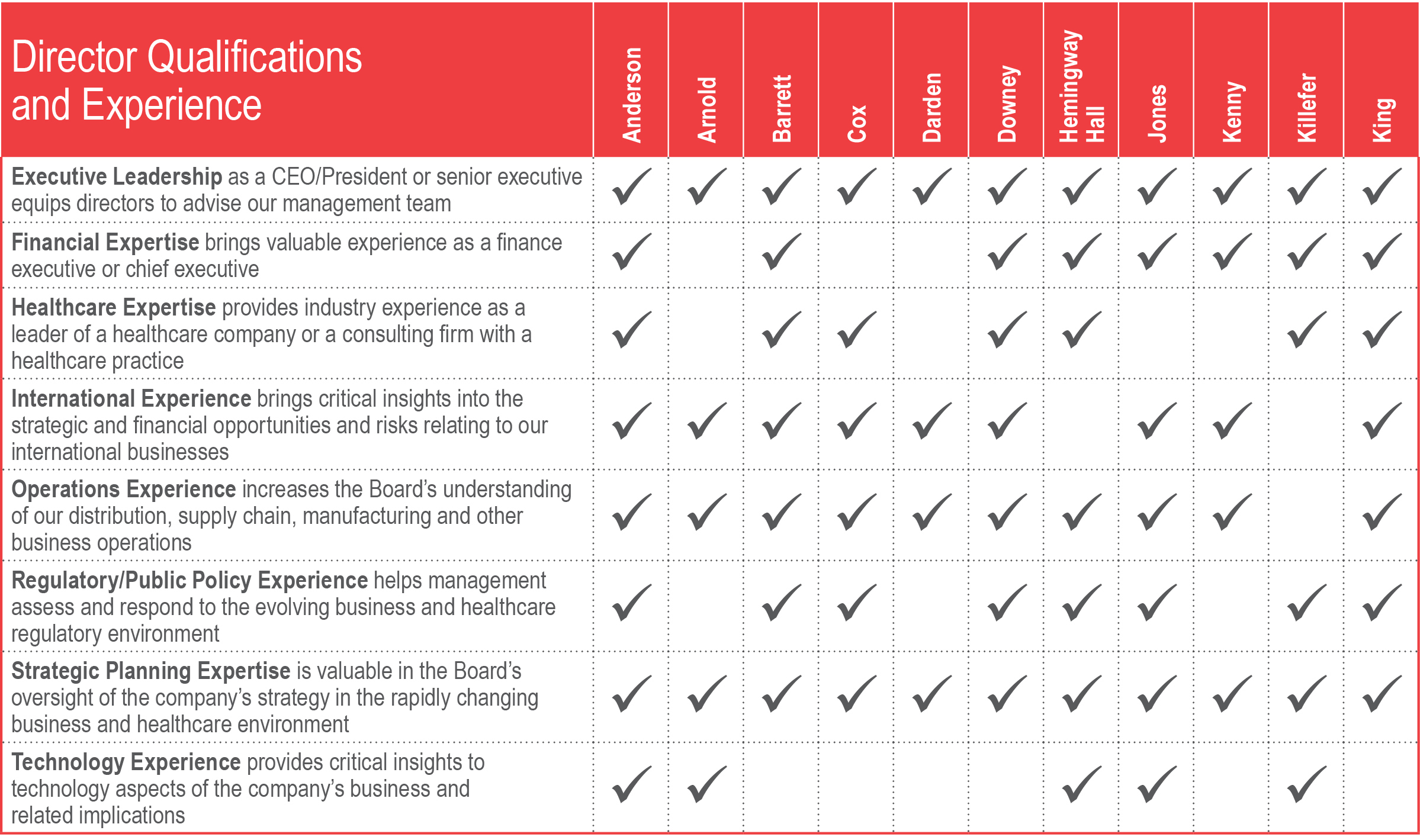

Our director nominees possess relevant skills and experience that contribute to a well-functioning Board that effectively oversees our strategy and management.

| Director Nominee Skills and Experience |  |  |  |  |  |  |  |  |  |  |  |

| Board leadership as a board chair, lead director, or committee chair equips directors to lead our Board and its committees |  |  |  |  |  |  |  |  |  | ||

| Financial expertise as a finance executive or CEO brings valuable experience to the Board and our management team |  |  |  |  |  |  |  |  |  | ||

| Healthcare expertise as a leader of a healthcare company or a consulting firm with a healthcare practice provides industry experience |  |  |  |  |  |  |  |  | |||

| Operations experience increases the Board’s understanding of our distribution and manufacturing operations |  |  |  |  |  |  | |||||

| Regulatory/legal/public policy experience helps the Board assess and respond to an evolving business and healthcare regulatory environment |  |  |  |  |  |  | |||||

| International experience brings critical insights into the opportunities and risks of our international businesses |  |  |  |  |  |  |  |  | |||

| Information technology/cybersecurity experience contributes to the Board’s understanding of the information technology aspects of our business as well as cybersecurity policy |  |  |  |  |  | ||||||

| Demographic Background | |||||||||||

| African American/Black |  | ||||||||||

| Asian |  |  | |||||||||

| White |  |  |  |  |  |  |  |  | |||

| Gender | |||||||||||

| Female |  |  |  |  |  |  | |||||

| Male |  |  |  |  |  |

CARDINALHEALTH 2023 Proxy Statement |20

The Board has an independent, non-executive chair leadership structure. Mr. Kenny has served as Chairman of the Board since we first implemented this structure in 2018.

In addition to serving as a liaison between the Board and management, key responsibilities of the Chairman include:

| • | calling meetings of the Board and independent directors; |

| • | setting the agenda for Board meetings in consultation with the other directors, the CEO, and the Corporate Secretary; |

| • | reviewing Board meeting schedules to ensure that there is sufficient time for discussion of all agenda items; |

| • | reviewing and approving Board meeting materials before circulation and providing guidance to management on meeting presentations; |

| • | chairing Board meetings, including the executive sessions of the independent directors; |

| • | participating in the annual CEO performance evaluation; |

| • | conferring with the CEO on matters of importance that may require Board action or oversight; |

| • | as a member of the Governance and Sustainability Committee, evaluating potential director candidates, assisting with director recruitment, recommending committee chairs and membership, and recommending updates to the company’s Corporate Governance Guidelines; and |

| • | holding governance discussions with institutional investors. |

Mr. Kenny’s prior experience serving as our independent Lead Director and chairing our Governance and Sustainability and Compensation Committees, as well as his experience chairing other public company boards and board committees, positions him to effectively lead the Board. Our CEO, Mr. Hollar, draws on his knowledge of our daily operations and of our industry, customers, suppliers, employees, and shareholders to provide the Board with a unique and important perspective on our business. The Board believes the current leadership structure of an independent Chairman of the Board and a separate CEO best serves the company and its shareholders. The structure facilitates robust communications between management and the Board and provides effective oversight by independent directors.

Our Corporate Governance Guidelines provide that, whenever possible, the Chairman of the Board shall be an independent director. The Guidelines further provide that if the Chairman is not independent, the independent directors will elect an independent director to serve as Lead Director. The Governance and Sustainability Committee and the Board periodically evaluate succession plans for the Board chair role.

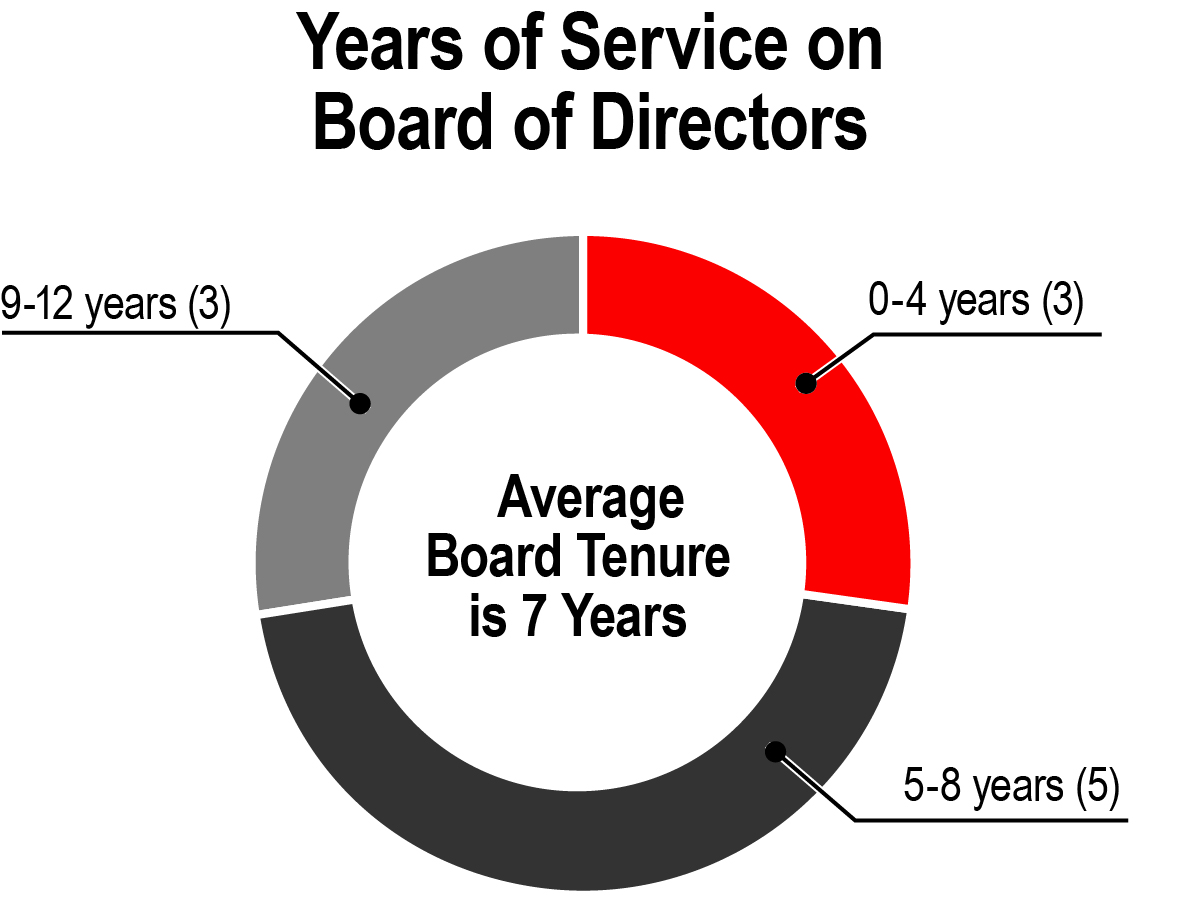

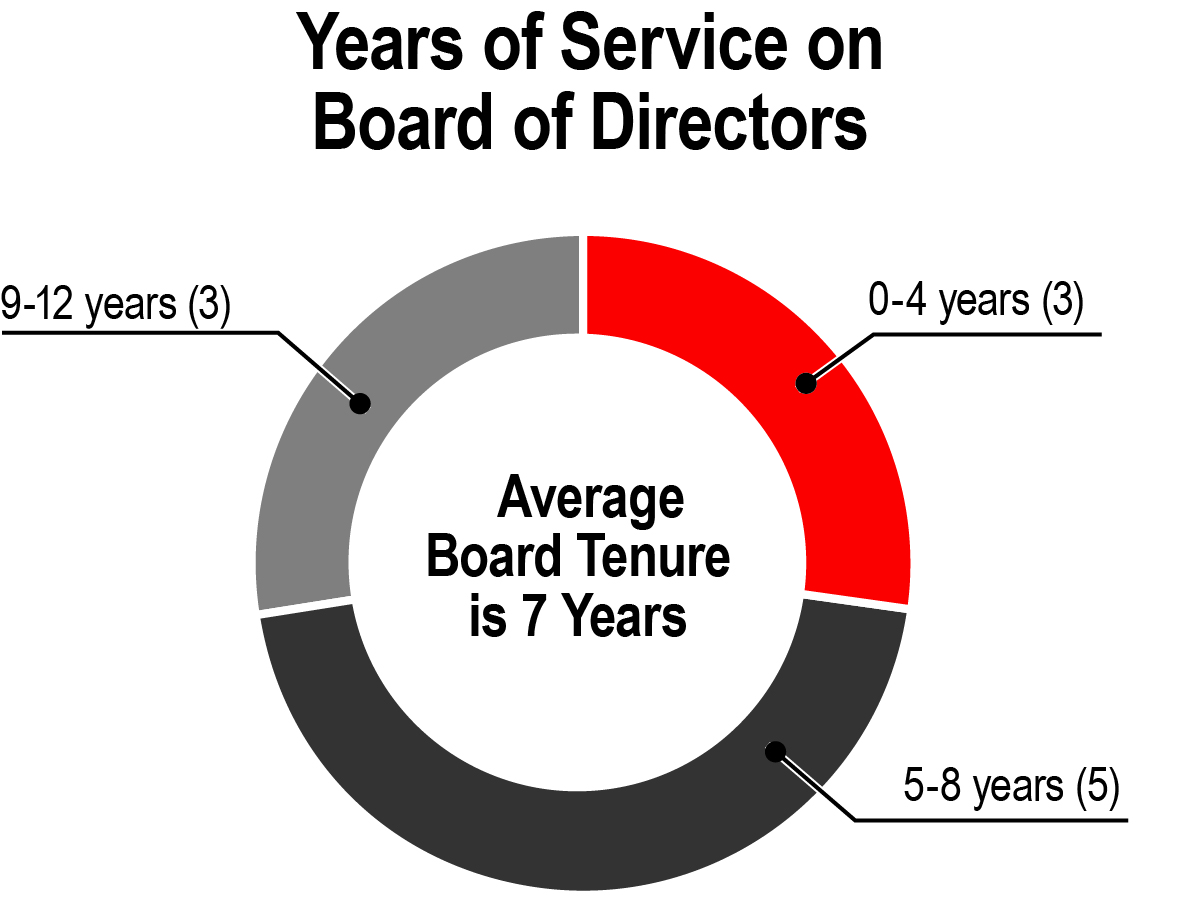

Our Corporate Governance Guidelines provide that the Board seeks to achieve diversity of occupational and personal backgrounds on the Board, including race and gender diversity. We believe that our Board nominees reflect an appropriate mix of skills, experience, and backgrounds and strike the right balance of longer serving and newer directors.

Our Corporate Governance Guidelines provide that, as part of the search process for each new director, the Governance and Sustainability Committee includes, and instructs any search firm to include, women and racially and ethnically diverse candidates in the pool from which candidates are selected. See the director skills matrix on page 20 for the self-identified gender and race/ethnicity of our director nominees.

CARDINALHEALTH 2023 Proxy Statement |21

The Governance and Sustainability Committee is responsible for identifying, reviewing, and recommending director candidates, and our Board is responsible for selecting candidates for election as directors based on the Governance and Sustainability Committee’s recommendations.

Considering the impending director departures at the Annual Meeting, the Governance and Sustainability Committee is assessing the composition of the board to ensure that it has the right mix of experience, skills, and diverse backgrounds to effectively oversee the company. The Governance and Sustainability Committee has engaged a search firm to assist with identifying and evaluating potential Board candidates.

New directors typically participate in a comprehensive director orientation program, which includes meetings with senior management. This orientation program helps new directors become familiar with our business and strategy, significant financial matters, information technology and security matters, our legal, governance, quality, and compliance programs, and our approach to human resources management.

We encourage our directors to attend outside director and other continuing education programs and make available to directors information on director education programs that might be of interest on developments in our industry, corporate governance, regulatory requirements and expectations, the economic environment, and other matters relevant to their duties as directors. In the past year, our directors have attended programs sponsored by the National Association of Corporate Directors, among others.

We also provide additional director educational opportunities internally through presentations on topics such as healthcare industry trends, ESG developments, regulatory compliance, cybersecurity, and directors’ legal duties. During fiscal 2023, directors held one of their quarterly meetings off-site and had the opportunity to tour facilities and meet with employees.

The Governance and Sustainability Committee and the Board believe that setting a retirement age for Cardinal Health directors is advisable to facilitate the addition of new directors. Accordingly, our Corporate Governance Guidelines provide that a director will not be nominated for re-election after their 75th birthday.

Directors are expected to commit sufficient time and attention to the activities of the Board. In accordance with our Corporate Governance Guidelines, except as approved by the Board:

| • | directors who serve as executive officers of a public company, including Cardinal Health, should not serve on more than one outside public company board; and |

| • | other directors should not serve on more than three public company boards in addition to our Board. |

Directors must advise the Chairman of the Board, the Chair of the Governance and Sustainability Committee, and the Corporate Secretary in advance of accepting an invitation to serve on another board.

In August 2022, the Governance and Sustainability Committee approved amendments to the Corporate Governance Guidelines that formalized an annual review of director capacity and outside public company board commitments. In this annual review, the Governance and Sustainability Committee may consider all factors it deems to be relevant, including the following:

| • | meeting attendance; |

| • | whether the director is currently employed or retired from full-time employment; |

| • | the number of other boards of which the director is a member, and the commitment levels and time demands of such other boards; |

| • | the role of a director on other boards (with consideration given to public company board leadership positions); |

| • | any industry or other commonalities between outside boards that aid in the director’s efficiencies serving on such boards; |

| • | any other outside commitments; |

| • | individual contributions at our Board and committee meetings; |

| • | peer review feedback from directors throughout the year (if any) and the results of the annual Board evaluation; and |

| • | the director’s general engagement, effectiveness, and preparedness. |

The Governance and Sustainability Committee conducted a review of director capacity for our 2023 director nominees and affirms that they are compliant with our outside board commitments policy.

CARDINALHEALTH 2023 Proxy Statement |22

The Board held 12 meetings during fiscal 2023. Each director attended 75% or more of the meetings of the Board and Board committees on which they served during the fiscal year. Average director attendance across all Board and Board committee meetings was 96%.

All our then-current directors attended the annual meeting of shareholders last year. Absent unusual circumstances, each director is expected to attend the annual meeting of shareholders.

The Board has four standing committees: the Audit Committee; the Governance and Sustainability Committee; the Human Resources and Compensation Committee (the “Compensation Committee”); and the Risk Oversight Committee. Each member of these committees is independent under our Corporate Governance Guidelines and under applicable committee independence rules.

The charter for each of these committees is available on our website at www.cardinalhealth.com under “About Us — Corporate — Investor Relations — Governance — Committee Composition.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

In addition to its four standing committees, the Board has a Business Review Committee that was formed on September 6, 2022 under the Cooperation Agreement. On May 3, 2023, the term of the Business Review Committee was extended until July 15, 2024. The Board also had an Ad Hoc Committee on Opioids, which was formed in 2018 to assist the Board in its oversight of opioid-related issues, until November 2022 when it met for the last time, transitioned its responsibilities to the Risk Oversight Committee, and terminated.

| Members:(1) |

4 Meetings | ||||||

|  |  |  |  | |||

| Akhil Johri (Chair) | Michelle M. Brennan(2) | Sujatha Chandrasekaran(2) | Sheri H. Edison(2) | David C. Evans |

The Audit Committee’s primary duties are to:

| • | oversee the integrity of our financial statements, including reviewing annual and quarterly financial statements and earnings releases and the effectiveness of our internal and disclosure controls; |

| • | appoint the independent auditor and oversee its qualifications, independence, and performance, including pre-approving all services by the independent auditor; |

| • | review our internal audit plan and oversee our internal audit department; |

| • | oversee our compliance with legal and regulatory requirements with respect to audit, accounting, and financial disclosure matters and related internal controls(3); and |

| • | oversee our major financial risk exposures, our cybersecurity and other major information technology risk exposures, and our process for assessing and managing risk through our enterprise risk management program. |

The Board has determined that each of Messrs. Evans and Johri is an “audit committee financial expert” for purposes of the SEC rules.

| (1) | John H. Weiland was a member of the Audit Committee until his term expired at the 2022 annual meeting of shareholders. |

| (2) | Mses. Brennan, Chandrasekaran, and Edison became members of the Audit Committee on September 6, 2022. |

| (3) | The Audit Committee Charter provides that the Audit Committee oversees compliance with legal and regulatory requirements in coordination with the Risk Oversight Committee, except that the Audit Committee is solely responsible for compliance with audit, accounting, and financial disclosure matters and related internal controls. |

CARDINALHEALTH 2023 Proxy Statement |23

| Members:(1) |

7 Meetings | ||||||

|  |  |  |  |  | ||

| Patricia A. Hemingway Hall (Chair) | Steven K. Barg(2) | Carrie S. Cox(2) | Bruce L. Downey(3) | Gregory B. Kenny | Nancy Killefer(2) |

The Governance and Sustainability Committee’s primary duties are to:

| • | identify, review, and recommend candidates for the Board, including recommending criteria to the Board for potential Board candidates and assessing the qualifications, attributes, skills, contributions, and independence of individual directors and director candidates; |

| • | oversee the Board’s succession planning; |

| • | make recommendations to the Board concerning the structure, composition, and functions of the Board and its committees, including Board leadership and leadership structure; |

| • | oversee our ESG activities, policies, strategy, and reporting and disclosure practices (except to the extent such matters are overseen by another Board committee), and monitor and evaluate environmental, social, and political issues and risks potentially impacting the company; |

| • | oversee our policies and practices regarding political and lobbying activities and expenditures, including an annual review of our political contributions policy, corporate political contributions, lobbying activities, and trade association payments; |

| • | review our Corporate Governance Guidelines and governance practices and recommend changes; and |

| • | conduct the annual Board evaluation and oversee the process for the evaluation of each director. |

| (1) | Mr. Johri was a member of the Governance and Sustainability Committee until September 6, 2022. |

| (2) | Mses. Cox and Killefer and Mr. Barg became members of the Governance and Sustainability Committee on September 6, 2022. Ms. Cox has decided not to stand for re-election at the Annual Meeting. |

| (3) | Mr. Downey was not nominated for re-election at the Annual Meeting because he has reached the director retirement age of 75. |

| Members:(1) |

8 Meetings | ||||||

|  |  |  |  | |||

| Carrie S. Cox (Chair)(2) | Michelle M. Brennan(3) | Patricia A. Hemingway Hall | Nancy Killefer | Christine A. Mundkur(3) |

The Compensation Committee’s primary duties are to:

| • | approve compensation for the CEO, establish relevant performance goals, and evaluate his performance; |

| • | approve compensation for our other executive officers and oversee their performance evaluations; |

| • | make recommendations to the Board with respect to the adoption of equity and incentive compensation plans and policies, administer such plans and policies, and determine whether to recoup compensation; |

| • | review our non-management directors’ compensation program and recommend changes to the Board; |

| • | oversee the management succession process for the CEO and senior executives; |

| • | oversee and advise the Board about human capital management strategies and policies, including with respect to attracting, developing, retaining, and motivating management and employees, workplace DE&I initiatives and progress, employee relations, and workplace safety and culture; |

| • | oversee and assess any material risks related to compensation arrangements; and |

| • | assess the independence of the Committee’s consultant and evaluate its performance. |

The CD&A, which begins on page 40, discusses how the Compensation Committee makes compensation-related decisions regarding our named executive officers.

| (1) | Dean A. Scarborough was a member of the Compensation Committee until his term expired at the 2022 annual meeting of shareholders. |

| (2) | Ms. Cox has decided not to stand for re-election at the Annual Meeting. She will continue to serve as the Committee Chair through the November quarterly meeting, following which a new Committee Chair will be appointed. |

| (3) | Mses. Brennan and Mundkur became members of the Compensation Committee on September 6, 2022. |

CARDINALHEALTH 2023 Proxy Statement |24

| Members:(1) |

4 Meetings | ||||||

|  |  |  |  | |||

| Sheri H. Edison (Chair)(2) | Sujatha Chandrasekaran(2) | Bruce L. Downey(2) | David C. Evans(2) | Christine A. Mundkur(2) |

The Risk Oversight Committee assists the Board in monitoring and overseeing risks associated with the company’s operations, including risks associated with ethical, quality, and legal and regulatory compliance matters (other than financial matters overseen by the Audit Committee). The Risk Oversight Committee’s primary duties are to:

| • | oversee our ethics and compliance program; |

| • | oversee our compliance with laws and regulations in areas such as healthcare fraud and abuse, antitrust, data privacy and security, and other areas of significant legal and compliance risk; |

| • | oversee our compliance with laws and regulations related to anti-bribery and anti-corruption laws, including the U.S. Foreign Corrupt Practices Act; |

| • | oversee our product quality and safety program, including compliance with laws and regulations related to the manufacture, sourcing, importation, and distribution of medical and pharmaceutical products; and |

| • | evaluate the performance of the Chief Legal and Compliance Officer and recommend to the Board the appointment of the Chief Legal and Compliance Officer. |

The Risk Oversight Committee coordinates with the Audit Committee in monitoring compliance by the company with legal and regulatory requirements as they relate to the responsibilities of the Audit Committee. Mses. Chandrasekaran and Edison and Mr. Evans sit on the Audit Committee.

| (1) | Messrs. Scarborough and Weiland were members of the Risk Oversight Committee until their terms expired at the 2022 annual meeting of shareholders. Ms. Killefer and Mr. Kenny were members of the Risk Oversight Committee until September 6, 2022. |

| (2) | Ms. Edison replaced Mr. Weiland as the Committee Chair and Mses. Chandrasekaran and Mundkur and Messrs. Downey and Evans became members of the Risk Oversight Committee on September 6, 2022. Mr. Downey was not nominated for re-election at the Annual Meeting because he has reached the director retirement age of 75. |

| Members: |

11 Meetings | ||||||

|  |  | |||||

| Jason M. Hollar (Chair) | Steven K. Barg | Akhil Johri |

Under the Cooperation Agreement, the Board established an advisory Business Review Committee to conduct a comprehensive review of the company’s strategy, portfolio, capital allocation framework, and operations. Since its formation on September 6, 2022, the Business Review Committee has been reviewing and making recommendations to the Board regarding the following matters:

| • | the company’s portfolio of businesses and assets (including identifying and evaluating potential opportunities and options that may be available, relative to the current configuration of the businesses, as well as potential strategic opportunities with respect to the businesses); |

| • | the strategy, operations, and business of the company (including identifying opportunities to enhance the competitive positioning and business and financial profile of the company’s assets and businesses, both individually and as a whole, taking into account the portfolio review and the results of the review); |

| • | long-term planning, priorities, corporate strategies, and oversight; |

| • | capital allocation priorities, including as to capital return policies, multi-year financial plans, and any additional capital return opportunities resulting from the portfolio review; and |

| • | any other related matters as may be determined by the Board from time to time. |

Results of the review to date were reported to the company’s shareholders at an Investor Day held on June 8, 2023. On May 3, 2023, in connection with the extension of the term of the Cooperation Agreement, the Board extended the term of the Business Review Committee until July 15, 2024.

CARDINALHEALTH 2023 Proxy Statement |25

Our Corporate Governance Guidelines provide that our Board serves as the representative of, and acts on behalf of, all the shareholders of Cardinal Health. The Board, operating directly and through its committees, fulfills the following primary functions:

| • | oversees management in the conduct of Cardinal Health’s businesses; |

| • | oversees management’s efforts to establish and maintain for the company high standards of legal and ethical conduct in all of its businesses, including conformity with all applicable laws and regulations; |

| • | reviews, evaluates, and, where appropriate, approves the company’s major business strategies, capital deployment, and long-term plans and reviews its performance; |

| • | selects, evaluates, and sets the compensation for the CEO and other senior officers and plans for management succession; |

| • | oversees management’s efforts to protect the assets of Cardinal Health through the maintenance of appropriate accounting, financial reporting, and financial and other controls; |

| • | oversees the company’s policies and procedures for assessing and managing risk; |

| • | provides advice and counsel to senior management; |

| • | evaluates the overall effectiveness of the Board and its committees; and |

| • | evaluates, selects, and recommends an appropriate slate of candidates for election as directors. |

The Board receives updates on company performance and regularly discusses our strategy considering the competitive environment, developments in the rapidly changing healthcare industry, and the global business and economic environment. The Board reviews and approves capital deployment, including dividends, financing and share repurchase plans, and significant acquisitions and divestitures.

At least annually, the Board conducts a dedicated strategy session with in-depth discussions of our industry, specific businesses, and new business opportunities. At these sessions, the Board also discusses risks related to our strategies, including risks resulting from possible actions by competitors, disrupters, customers, and suppliers. The Board also considers various elements of strategy at each regular quarterly meeting. The collective backgrounds, skills, and experiences of our directors, including broad industry experience, contribute to robust discussions of strategy and the related risks.

As described elsewhere in this proxy statement, on September 6, 2022, we established an advisory Business Review Committee under the Cooperation Agreement to conduct a comprehensive review of the company’s strategy, portfolio, capital allocation framework, and operations. In connection with the extension of the Cooperation Agreement term, the Board extended the term of the Business Review Committee until July 15, 2024.

CARDINALHEALTH 2023 Proxy Statement |26

A summary of the allocation of general risk oversight functions among management, the Board, and the Board’s committees follows below.

Management has day-to-day responsibility for assessing and managing risks, and the Board is responsible for risk oversight. Management has developed and administers an enterprise risk management (“ERM”) program, which the Audit Committee oversees. Through this ERM program, management identifies and prioritizes enterprise risks and develops systems to assess, monitor, and mitigate those risks. Management reviews and discusses with the Board and its committees significant risks facing the company.

Our internal audit function, which the Audit Committee oversees, also helps to identify and mitigate risks and improve internal controls.

The Risk Oversight Committee assists the Board in monitoring and overseeing risks associated with our operations, including risks associated with ethical, quality, and legal and regulatory matters.

The Risk Oversight Committee oversees our ethics and compliance program, product quality and safety program, and our compliance with legal and regulatory requirements other than audit, accounting, and financial disclosure matters and related internal controls, which are overseen by the Audit Committee. The Risk Oversight Committee receives quarterly updates from senior leadership regarding all the areas that the Committee oversees, and the Board receives annual updates from senior leadership regarding our ethics and compliance program and our product quality and safety program.

The Risk Oversight Committee coordinates with the Audit Committee in monitoring compliance by the company with legal and regulatory requirements as they relate to the responsibilities of the Audit Committee. To facilitate this coordination, Risk Oversight Committee Chair Edison and Risk Oversight Committee members Chandrasekaran and Evans sit on the Audit Committee.

CARDINALHEALTH 2023 Proxy Statement |27